Who Should Register with the FIUTT

All businesses, companies and individuals that perform the functions listed in the First Schedule of the Proceeds of Crime Act, Chap 11:27 and non-regulated financial institutions as defined in Section 2 of the Financial Intelligence Unit of Trinidad and Tobago Act are required to register with the FIUTT. These businesses, categorized as non-regulated financial institutions or listed businesses are collectively called Supervised Entities.

Please consult the FIUTT List of Supervised Sectors to confirm whether you need to be registered with the FIUTT.

How to Register with the FIUTT

The FIUTT’s registration process is simple 4-stage process:

- Confirm your business is required to register;

- Download and complete the Listed Businesses (LB) form or the Non-Regulated Financial Institutions (NRFIs) form either electronically or manually with a blue ink pen;

- The Registration Document Checklist (LB or NRFI) and the Fit and Proper Declaration Form.

- Print and sign the forms;

- Submit the form to the Director of the FIUTT along with copies of IDs, Compliance Officer Fit and Proper Questionnaire, Certificate of Incorporation and any other relevant documents requested by the FIUTT.

- Please see the Guidelines on the Registration Framework for Supervised Entities

- For more information please consult the FIUTT’s FAQs.

Remember to:

- Complete all fields

- Include accurate information

- Insert details for all directors, owners or partners

- Submit in a sealed envelope to:

The Director

Financial Intelligence Unit of Trinidad and Tobago

Level 25, Tower D

International Waterfront Complex

1A Wrightson Road

Port of Spain

Trinidad, West Indies

Mandatory Registrant Update Initiative for Supervised Entities

In accordance with Regulation 29A (1) of The Financial Intelligence Unit of Trinidad & Tobago Regulations, all supervised entities are required to notify the FIUTT of any changes to their business operations.

To maintain accurate and up-to-date records, the FIUTT is conducting a mandatory registrant update initiative.

All supervised entities must submit their most current information using the link or QR code provided below:

- Submit your information here: FIUTT Registrant Update Form

- Scan the QR Code

Deadline for submission: July 25, 2025.

You are reminded that pursuant to Regulations 29(2) and 29A(2), where a supervised entity fails to notify the FIUTT of any change specified above, the supervised entity commits an offence and shall be liable on summary conviction to a fine of twenty thousand dollars.

Thank you for your prompt attention and cooperation.

Money or Value Transfer Service Provider Business

Money or Value Transfer Service (MVTS) business as defined in Section 2 of the Financial Obligations Regulations, 2010 means ‘a financial service that accepts cash, cheques, other monetary instruments or other stores of value, in one location and pays a corresponding sum in cash or other form to a beneficiary in another location, by means of a communication, message, transfer or through a clearing network to which the money or value transfer service belongs’. In accordance with sections 2 and 18A of the Financial Intelligence Unit Act, Chap. 72:01 (“the FIU Act”), the FIUTT is the designated AML/CFT Supervisory Authority for businesses performing the services of an MVTS.

Businesses that perform MVTS activities are required to register with the FIUTT in accordance with Section 18B of the FIU Act. The E-Money Issuer Order, 2020 introduces two (2) classes of business permitted by law to perform MVTS activities:

- Payment Service Providers defined in Clause 2 of The E-Money Issuer Order, 2020 as businesses that provide a service which enables cash deposits and withdrawals, execution of a payment, the issue or acquisition of a payment instrument, the provision of a remittance service, and any other service functional to the transfer of money; and

- E-Money Issuer meaning a person (other than licensee of the Central Bank of Trinidad and Tobago) who is registered or has applied to be registered to issue e-money under Clause 3 of the E-Money Issuer Order, 2020. These include:

- Mobile Network Operators authorized by the Telecommunications Authority of Trinidad and Tobago;

- Technology Service Providers; and

- Other financial institutions, such as credit unions, insurance companies and the Trinidad and Tobago Unit Trust Corporation.

To register with the FIUTT, these business must comply with the registration guidelines issued jointly by the FIU and the Central Bank of Trinidad and Tobago.

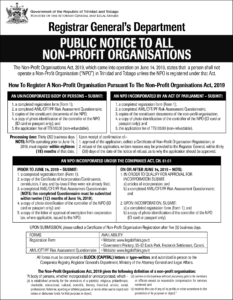

Where do NPOs Register?

All NPOs are required to register with the Registrar General Department (“RGD”) (http://www.legalaffairs.gov.tt/index.html) in accordance with Section 5 of the Non-Profit Organizations Act, No. 7 of 2019 (“NPOA”) (http://www.ttparliament.org/legislations/a2019-07.pdf) for the purpose of identifying yourself as an NPO.

Your application for registration under Section 5(4) of the NPOA must be submitted to the Registrar Generals’ Department. Please click on Public Notice to NPOs below for details:

Failure to register is an offence. A person who fails to register as an NPO under the NPOA with the RGD commits an offence and is liable on conviction on indictment to a fine of fifty thousand dollars ($50,000) and to imprisonment for seven (7) years.

NPOs are also notified of their anti-money laundering/counter financing of terrorism (AML/CFT) legal obligations to mitigate and report suspicious transactions/activities or possession of terrorist funds once identified in their due diligence processes. Further only those NPOs with an annual income of over Five Hundred Thousand Dollars ($500,000) will be supervised by the FIU. For detailed information on your AML/CFT obligation, please consult the FIU’s AML/CFT Guidance Note for NPOs.